Gaining Independence

Getting a Job and Keeping It

Gaining Independence

Getting a Job and Keeping It

&Understanding Money and Credit

Accessing Supports and Resources

Understanding Money and Credit

If you enroll in ILP, you will most likely have access to classes in financial literacy. Take advantage of these classes! You may also want to check out the resources, tools, and information listed here.

Managing Your Money

Tips for Teens (and More)

Work your way through earning, saving, spending, owing, tracking, giving, investing, and safeguarding your money! This is a website-based curriculum for teens developed by TheMint.org with how-to’s, tools, calculators, and tips. Check out these pages:

Generation Money

You will find information on creative entrepreneurship for teens, quizzes, tools, and articles. Check out the Channel One News site!

NerdWallet

Compare over 1700 credit cards, check out reward features, and read articles on the best credit cards for your financial situation.

Your Credit Report

If you are age 14 or older and still in foster care, your child welfare agency must obtain a copy of your credit report and, if you have one, assist you with interpreting and resolving any inaccuracies in the report.

It is important that your credit report is accurate and contains no mistakes. Foster youth often face higher instances of identity theft due to frequent changes in placements. Problems on your credit report can impact your ability to obtain a loan for school, lease a car or apartment, open a credit card, or even get a cell phone.

After you turn 18, be sure you continue to monitor your credit report. Look out for addresses of places where you did not live, names of employers you did not work for, and any other information that is not specifically about you. If you are in extended foster care, your social worker must help you resolve inaccuracies. If you are no longer in care, you can obtain assist from the U.S. Consumer Financial Protection Bureau.

Your credit history stays with you for many years so it’s important begin building good credit and make sound financial decisions. Here are some resources to help you understand the basics of identity theft protection, building good credit, and avoiding getting scammed.

-

Identity Theft Protection

Tips on how to keep your identity from getting trashed. What do you do if your wallet is stolen? How about computer viruses? Learn how to check for fishy stuff.

-

Building Good Credit

Tips for being smart with money, building your credit score, and learning how to budget. Find out ways to spend a little on yourself now and how to put a little away for the future you want.

-

Avoiding Scams and False Ads

Tips for foster youth on protecting yourself from scams and false advertising. Is that car worth it? What about payday loans? Scholarship and “work at home” scams? How do you tell the difference between email from legit businesses and phishing expeditions?

Financial Empowerment Toolkit Tip Sheets

From the U.S. Department of Health and Human Services, Administration for Children and Families, Office of Community Services (2014)

This toolkit was created specifically for youth and young adults in foster care. It provides very detailed information and practical tools on credit reports, plus additional tip sheets on taxes and insurance.

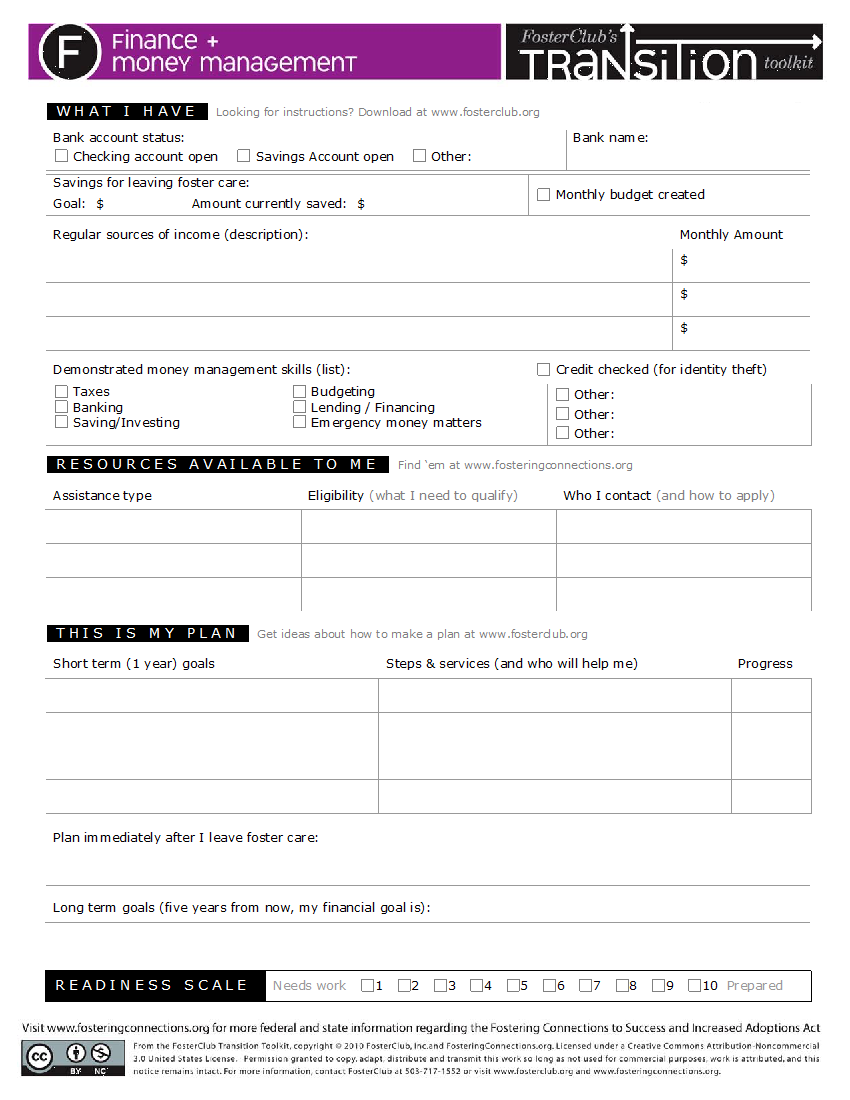

Finance + Money Management Plan

Use this tool to help you record your bank accounts, identify your money management skills, and develop a financial plan as you transition into adulthood.